How to Build Multiple Streams of Income for Your Retirement

Introduction

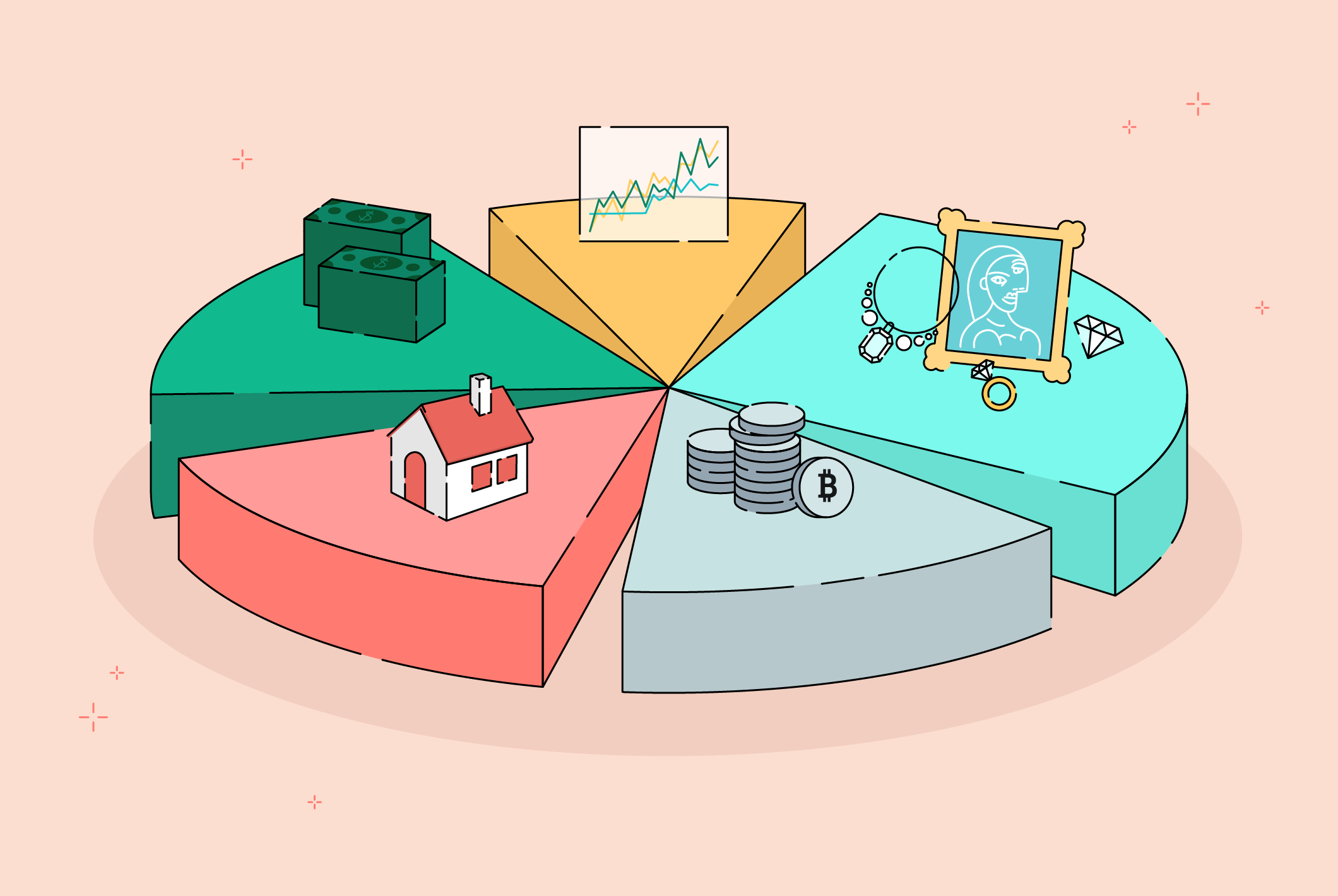

Achieving a financially secure retirement often involves more than just saving diligently throughout your working years. Building multiple streams of income can provide additional financial stability and peace of mind during retirement. Diversifying your income sources ensures you are not overly reliant on any single income stream and can help mitigate risks associated with market volatility and economic changes. Here are some strategies to help you build multiple streams of income for your retirement.

1. Understand the Importance of Diversified Income

Relying solely on one source of income, such as Social Security or a pension, can be risky. Diversified income provides financial security and flexibility, allowing you to maintain your lifestyle and cover unexpected expenses. By building multiple income streams, you can create a well-rounded retirement plan that supports your financial goals.

2. Maximize Social Security Benefits

Social Security benefits will likely form a cornerstone of your retirement income. To maximize your benefits, consider the following strategies:

- Delay Claiming Benefits: The longer you wait to claim Social Security, up to age 70, the higher your monthly benefits will be.

- Understand Your Benefits: Use the Social Security Administration’s tools to estimate your benefits based on your earnings history and decide the best time to start receiving payments.

- Spousal Benefits: If you’re married, explore the options for spousal benefits, which can provide additional income.

3. Invest in Dividend-Paying Stocks

Dividend-paying stocks can provide a reliable source of income during retirement. Companies that regularly pay dividends tend to be financially stable and profitable. By investing in a diversified portfolio of dividend-paying stocks, you can benefit from regular income payments and potential capital appreciation. Reinvesting dividends can further enhance your returns.

4. Create a Rental Income Stream

Real estate can be an excellent addition to your retirement income strategy. Consider purchasing rental properties to generate a steady stream of passive income. Rental properties can provide long-term appreciation and tax advantages, in addition to rental income. If managing properties isn’t appealing, you can also invest in Real Estate Investment Trusts (REITs) for exposure to real estate without the responsibilities of property management.

5. Develop a Part-Time Business or Freelance Career

Many retirees find fulfillment and financial benefits in developing a part-time business or freelance career. This could be based on your professional expertise, hobbies, or interests. Whether you offer consulting services, start an online store, or provide freelance writing or design work, a part-time business can generate additional income and keep you engaged and active.

6. Build an Investment Portfolio

A well-diversified investment portfolio can provide growth and income during retirement. Consider allocating your assets across various investment classes, such as stocks, bonds, mutual funds, and ETFs. Here are some investment strategies to consider:

- Growth Investments: Allocate a portion of your portfolio to growth-oriented investments, such as stocks, to achieve long-term capital appreciation.

- Income Investments: Include income-generating investments, such as bonds and dividend-paying stocks, to provide a steady income stream.

- Diversification: Diversify your portfolio to reduce risk and enhance returns. Consider including international investments, real estate, and alternative assets.

7. Explore Annuities

Annuities can provide a guaranteed income stream during retirement. By purchasing an annuity, you can receive regular payments for a specified period or for the rest of your life. There are various types of annuities to choose from, including fixed, variable, and indexed annuities. Be sure to research and understand the terms, fees, and benefits of annuities before investing.

8. Consider Part-Time Employment

Part-time employment can provide additional income and keep you socially and mentally engaged. Many retirees choose part-time work in fields they are passionate about or explore new industries. Part-time employment offers flexibility and can help bridge the gap between your retirement income and expenses.

9. Utilize Tax-Advantaged Accounts

Maximizing contributions to tax-advantaged retirement accounts, such as 401(k)s, IRAs, and Roth IRAs, can significantly boost your retirement savings. These accounts offer tax benefits that can enhance your overall returns. Be sure to understand the contribution limits and withdrawal rules to make the most of these accounts.

10. Explore Passive Income Opportunities

Passive income opportunities can provide a steady stream of income with minimal effort once set up. Some passive income ideas include:

- Royalty Income: If you have creative works, such as books, music, or patents, you can earn royalties.

- Peer-to-Peer Lending: Invest in peer-to-peer lending platforms to earn interest on loans.

- Invest in Businesses: Consider investing in small businesses or startups through platforms like equity crowdfunding.

Conclusion

Building multiple streams of income for your retirement can provide financial security and peace of mind. By diversifying your income sources, you can reduce the risk of relying on a single income stream and ensure a more stable and comfortable retirement. Consider strategies such as maximizing Social Security benefits, investing in dividend-paying stocks, creating rental income, developing a part-time business, building an investment portfolio, exploring annuities, working part-time, utilizing tax-advantaged accounts, and exploring passive income opportunities. With careful planning and proactive management, you can create a well-rounded retirement income strategy that supports your financial goals and enhances your quality of life.