How to Create a Retirement Budget That Works for You

Introduction

Planning for retirement involves more than just saving money. To ensure your retirement years are financially secure and stress-free, creating a well-thought-out retirement budget is essential. A comprehensive budget helps you manage your expenses, prioritize your spending, and achieve your financial goals. Here’s how to create a retirement budget that works for you.

1. Assess Your Current Financial Situation

The first step in creating a retirement budget is to assess your current financial situation. Take a detailed inventory of your assets, liabilities, income, and expenses. This will give you a clear picture of your financial health and help you identify areas where you can make adjustments. Consider factors such as:

- Savings and Investments: Calculate the total amount you have saved in retirement accounts, brokerage accounts, and other investment vehicles.

- Debts: List any outstanding debts, including mortgages, loans, and credit card balances.

- Income Sources: Identify all potential sources of income during retirement, such as Social Security benefits, pensions, annuities, and rental income.

- Monthly Expenses: Track your current monthly expenses to understand your spending habits and identify areas where you can cut costs.

2. Estimate Your Retirement Expenses

Estimating your retirement expenses is crucial for creating a realistic budget. Consider both essential and discretionary expenses, such as:

- Housing: Include costs for mortgage or rent, property taxes, insurance, and maintenance.

- Healthcare: Account for premiums, copayments, prescription medications, and potential long-term care needs.

- Utilities: Include costs for electricity, water, gas, internet, and phone services.

- Transportation: Budget for car payments, insurance, fuel, maintenance, and public transportation.

- Food and Groceries: Estimate your monthly grocery bills and dining out expenses.

- Leisure and Entertainment: Include costs for hobbies, travel, dining out, and other recreational activities.

- Miscellaneous: Account for other expenses such as clothing, gifts, and personal care.

3. Prioritize Your Spending

Once you have a clear understanding of your expenses, prioritize your spending based on your needs and goals. Essential expenses, such as housing, healthcare, and utilities, should take priority over discretionary spending. Create categories for different types of expenses and allocate a portion of your income to each category. This will help you stay on track and avoid overspending.

4. Plan for Healthcare Costs

Healthcare is often one of the most significant expenses in retirement. To avoid financial strain, plan for healthcare costs by exploring your options for coverage. Consider enrolling in Medicare and purchasing supplemental insurance to cover additional expenses. Research long-term care insurance to protect yourself from the high costs of long-term care services. Additionally, maintain a healthy lifestyle to reduce the likelihood of costly medical issues.

5. Build an Emergency Fund

An emergency fund is essential for unexpected expenses that may arise during retirement. Aim to save three to six months’ worth of living expenses in a readily accessible account. This fund can help cover unexpected medical bills, home repairs, or other unforeseen costs without disrupting your retirement budget.

6. Diversify Your Income Sources

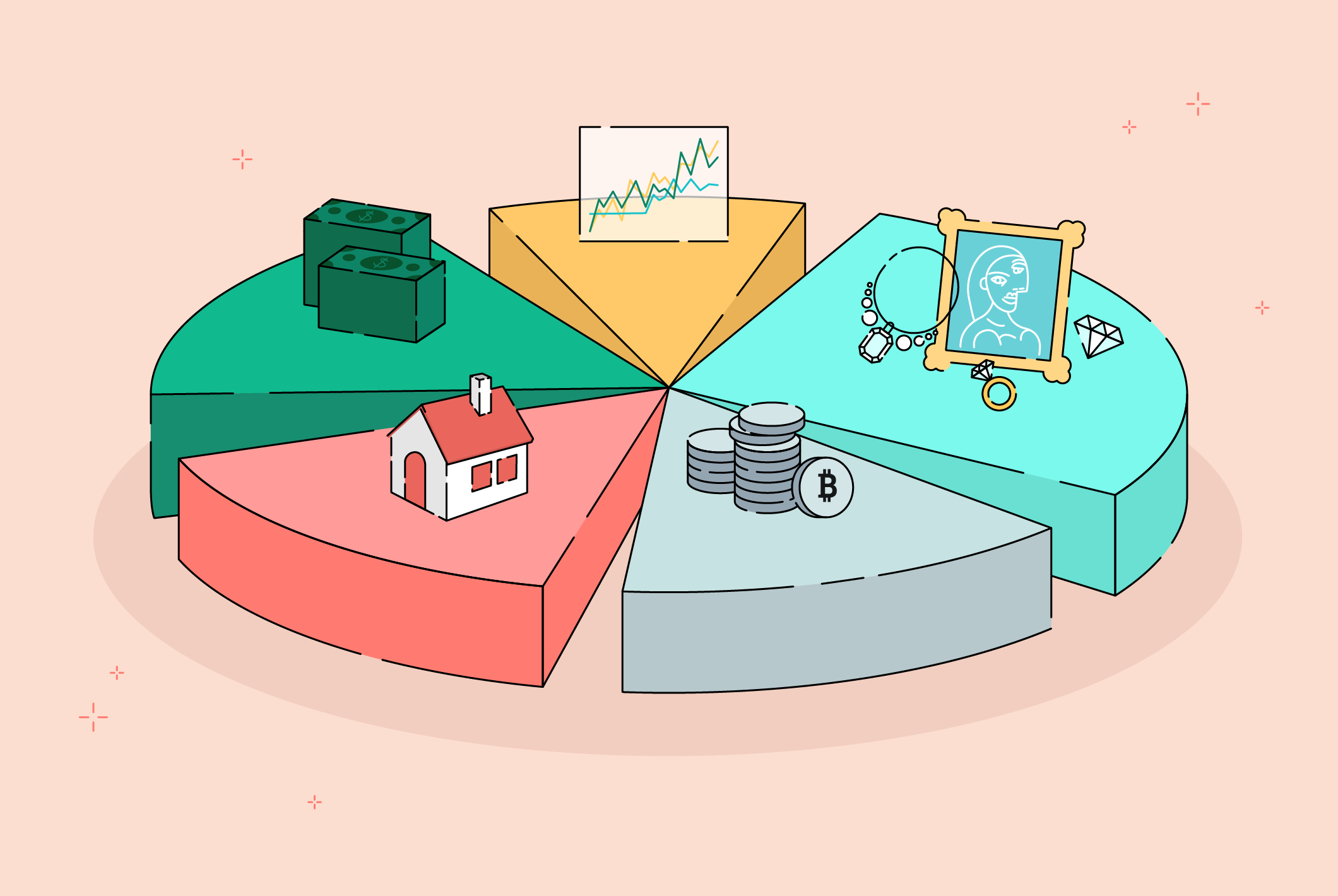

Relying on a single source of income can be risky. Diversify your income sources to ensure a steady cash flow during retirement. This may include Social Security benefits, pensions, annuities, part-time work, and investment income. Diversifying your income can provide financial stability and reduce the impact of market fluctuations on your retirement savings.

7. Monitor and Adjust Your Budget

Creating a retirement budget is not a one-time task. Regularly review and adjust your budget to account for changes in your financial situation and goals. Monitor your spending to ensure you are staying within your budget and make adjustments as needed. This will help you maintain control over your finances and achieve your retirement goals.

8. Seek Professional Advice

If you’re unsure about how to create a retirement budget or need help managing your finances, consider seeking professional advice. A financial advisor can provide personalized guidance and help you develop a comprehensive retirement plan. They can also assist with investment strategies, tax planning, and estate planning to ensure your financial security in retirement.

9. Plan for Inflation

Inflation can erode the purchasing power of your retirement savings over time. To protect yourself from inflation, include a buffer in your budget to account for rising costs. Consider investing in assets that historically outpace inflation, such as stocks, real estate, and inflation-protected securities. Regularly review your budget and adjust for inflation to ensure your savings maintain their value.

Conclusion

Creating a retirement budget that works for you is essential for ensuring financial security and peace of mind during your retirement years. By assessing your current financial situation, estimating your expenses, prioritizing your spending, and planning for healthcare costs, you can develop a comprehensive budget that aligns with your goals. Regularly monitor and adjust your budget, seek professional advice, and plan for inflation to maintain control over your finances and enjoy a fulfilling retirement.

Remember, a successful retirement plan requires careful planning, proactive management, and a willingness to adapt to changing circumstances. By taking these steps, you can create a retirement budget that works for you and provides the financial stability you need to make the most of your golden years.